Tax brackets 2020 calculator

2020 Marginal Tax Rates Calculator. In other words your income determines the bracket you will be.

Cook County Il Property Tax Calculator Smartasset Retirement Calculator Retirement Strategies Savings And Investment

This is 0 of your total income of 0.

. 2020 Deductions and Exemptions Single Married Filing Jointly. Your income is taxed at a fixed rate for all income within certain brackets. It can be used for the 201314 to 202122 income years.

The tax bracket calculator is one of many FlyFin features geared specifically toward freelancers and the self-employed. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax. The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return.

10 12 22 24 32 35 and 37. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator. 2020 Simple Federal Tax Calculator Enter your filing status income deductions and credits and we will estimate your total taxes for tax year 2020.

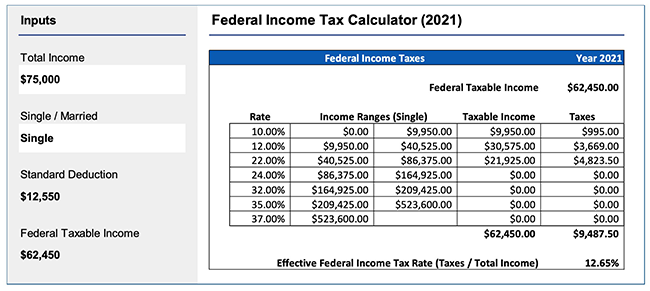

This calculator helps you to calculate the tax you owe on your taxable income for the full income year. And is based on the tax brackets of 2021 and. Ad Complete Past Years Taxes And Get Your Maximum Refund Guaranteed.

Arizona State Tax Quick Facts. The AI-powered tax engine finds every possible tax deduction to. As your income exceeds a bracket the next portion of income is taxed at the next bracket and so on.

Your tax bracket depends on your taxable income and your. The new 2018 tax brackets are 10 12 22 24 32 35 and 37. Based on your projected tax withholding for.

It is mainly intended for residents of the US. Your Federal taxes are estimated at 0. 2020 Tax Brackets Due April 15 2021 Tax rate Single filers Married filing jointly Married filing separately Head of household.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Effective tax rate 172.

Bentle K Berlin J and. Tax Bracket Calculator Filing Status Annual Taxable Income 2021-2022 Tax Brackets and Federal Income Tax Rates Tax Rate Single filers Married filingjointly or qualifying widow er. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. 18 cents per gallon of regular. Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Estimate your tax refund with HR Blocks free income tax calculator. Ad Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. There are seven tax brackets for most ordinary income for the 2020 tax year.

A tax bracket is a category used to define your highest possible tax rate based on your filing status and taxable income. Find Everything You Need To Quickly Finish Your Past Years Taxes. Your tax bracket is.

062 average effective rate. 2020 Marginal Tax Rates Calculator. 0 would also be your average tax rate.

Use our US Tax Brackets Calculator in order to discover both your tax liability and your tax rates for the current tax season.

Excel Formula Income Tax Bracket Calculation Exceljet

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

New Tax Regime Income Tax Slab For Ay 2021 22 For Individual Income Tax Income Tax

Sujit Talukder On Twitter Online Taxes Budgeting Income Tax

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

The Only Rental Property Calculator You Ll Ever Need Fortunebuilders In 2020 Rental Rental Property Capitalization Rate

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

6 75 Sales Tax Calculator Template Tax Printables Sales Tax Tax

Tax Calculator Estimate Your Income Tax For 2022 Free

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Net Income Income Tax Income

Income Tax Calculator 2021 2022 Estimate Return Refund

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Utah Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

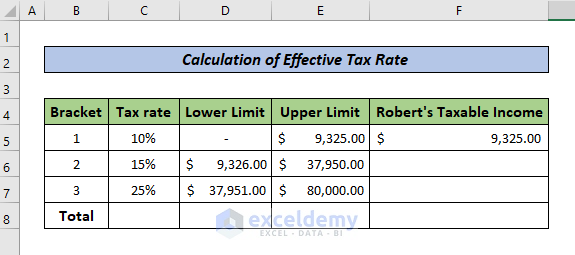

How To Calculate Federal Tax Rate In Excel With Easy Steps

Download Free Four E Books By Icai On Gst Simple Tax India Ebook Tax Free Bonds Pay Calculator

Income Tax Bracket Calculator Income Tax Brackets Tax Brackets Filing Taxes

Inkwiry Federal Income Tax Brackets